Marketing Research Agency, Canalys , has published a new report that shows Xiaomi is growing rapidly in Latin America. In the third quarter of 2021, the Chinese manufacturer will become the third largest smartphone brand in the region by shipments. In Latin America, Xiaomi currently holds 11% of the market. Xiaomi is currently the number one smartphone manufacturer in Peru and second in Colombia. ... Its market share in the third quarter of 2021 in these countries will be 31% and 27%, respectively.

In 2017, Xiaomi entered the markets of Colombia, Chile and Mexico. At the time, the company sold an average of 290 units per quarter in these markets. Over time, Xiaomi's strategy in Latin America has undergone tremendous changes. In 000, the company entered two more Latin American markets, Peru and Brazil. In the same year, Xiaomi recorded 2019% annual growth in Colombia and 200% in Mexico.

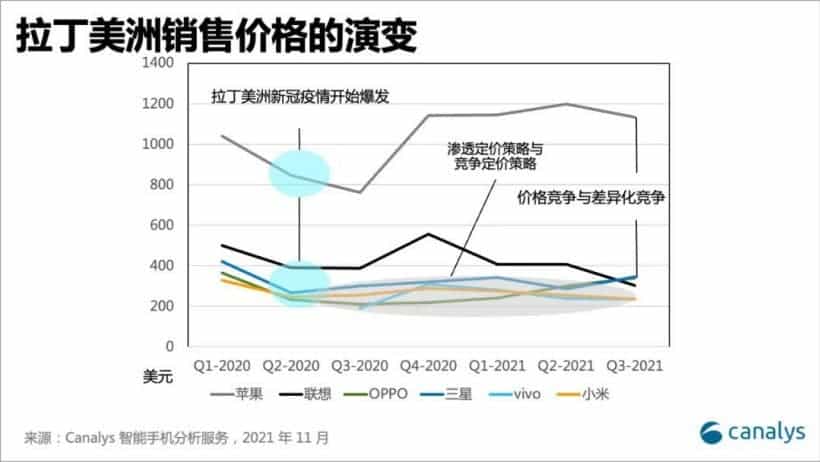

Canalys announced that in 2019 at communication channels accounted for about 64% of shipments in Latin America ... At that time, Xiaomi began to focus on communication channels and integrate channel resources. In addition, the scope of sales of Xiaomi mobile phones has expanded from the price range of $ 100-299 for models to $ 100 and $ 400 and above. Over the years, Xiaomi's shipments to Latin America have increased by nearly 200% year on year.

Xiaomi cooperation with local operators is the key to success

Mid 2020 the company has appointed a new director who will lead the business in the region ... Xiaomi has signed a new alliance agreement with America Movil, the largest local operator. This helped boost Xiaomi's shipments to Colombia by 6500% year over year. In the Mexican market, the company's shipments also increased by 244% year on year. In Chile, the company's sales increased by 1610%. In addition, the online and offline retail channel business has been strengthened.

Xiaomi's marketing strategy led Chinese manufacturers such as Oppo , Vivo and ZTE, to enter the Latin American market. These brands have also adopted penetration marketing strategies in recent quarters, starting a price war and even rapidly overstepping certain price ranges. By the third quarter of 2021, ZTE had a 4% market share in Latin America. Additionally, Oppo has 3,4%, TCL has 2,5% and Vivo has 2%.

Xiaomi has always been good value for money. The company appears to be doing well in many emerging regions as well. These are the regions that seem to favor mid-range and entry-level pricing over flagship ones. The Redmi brand has a lot of decent smartphones that are affordable. However, the company's cooperation with local operators is its main breakthrough in the Latin American market.